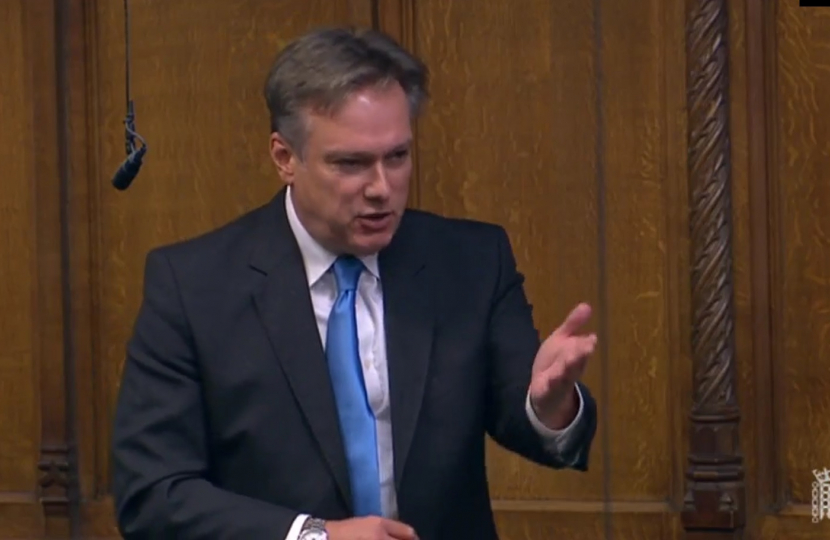

- Henry Smith MP has welcomed a tax cut for more than 4 million people in the south east of England thanks to the long-term decisions taken by the Government at the Autumn Statement for Growth.

- From 6th January 2024, National Insurance Contributions for 27 million working people have been cut from 12 per cent to 10 per cent, delivering a tax cut of £450 for the average worker earning £35,000.

- This means people will have more money in their pockets, helping to grow the economy and reward hard work.

Henry Smith MP has welcomed a tax cut for 4,090,000 people in the south east of England, saving workers an average of £450 a year.

Henry said;

“The Prime Minister made a promise that taxes would be cut when inflation was falling and that’s what this Government is delivering.

“More than 4 million people across the south east of England will have their taxes cut, thanks to Government’s long-term decisions for a stronger economy.

“This means people get to keep more of their hard-earned money, ensuring work always pays.”

Having met its target to halve inflation, the Government are now able to cut taxes.

From 6th January 2024 employee National Insurance Contributions will be cut from 12 per cent to 10 per cent, delivering a tax cut of £450 for the average worker earning £35,000.

The Government will also cut National Insurance for the Self-Employed, delivering a total average saving of £340 a year which will come into force later this year.

Last week’s tax cut means a senior nurse with five years of experience will receive an annual gain of £600; a typical police officer will receive an annual gain of over £630; a typical junior doctor will receive an annual gain of over £750 and a hard-working family with two earners on the average income will be £900 better off a year.

This tax cut is only possible because of the long-term, difficult decisions the Government took to get inflation falling and strengthen the economy.

The Chancellor of the Exchequer, Jeremy Hunt, commented;

“With inflation halved, we’ve turned a corner and are cutting taxes – starting with today’s record cut to National Insurance worth nearly £1,000 for a household.

“From nurses and brickies, to cleaners and butchers, 27 million hard-working Brits will have a little more cash in their pockets.”