- Unemployment is at its lowest level since 1974 and there are record numbers of people on company payrolls – but global pressures are pushing up household costs, so the Government is committed to helping hard-working people keep more of the money they earn.

- From today the Government is delivering a £6 billion tax cut for 30 million working people across the United Kingdom, worth over £330 a year, by raising the National Insurance personal threshold from £9,500 to £12,570. This is the single largest cut to personal taxes in a decade and the largest increase in a starting personal tax threshold in British history.

- More people will be better off even after paying the new Health and Social Care levy as the Government cuts tax to ease the burden on households and rebuild our economy.

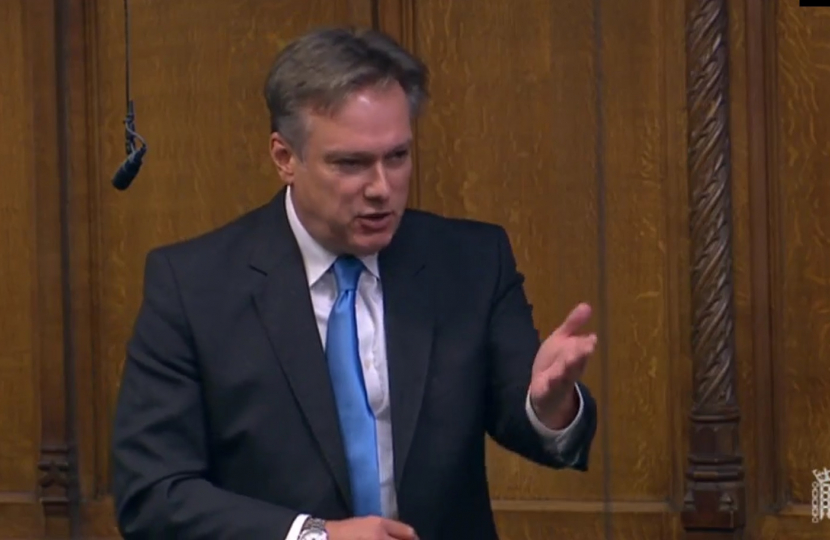

Henry Smith MP has welcomed the single largest cut to personal taxes in a decade for 2,670,000 workers across the south east of England.

The Government is delivering the single largest cut to personal taxes in a decade, bringing the personal threshold for National Insurance tax to £12,570, up from £9,500. This is a tax cut worth £6 billion to 30 million workers across the country.

This cut means the average worker will save up to £330 a year and for the first time, workers can earn up to £12,570 without paying a penny of Income Tax or National Insurance tax.

2,670,000 people across the south east of England will see a benefit of this cut, reducing burdens on household budgets and helping us rebuild our economy as more people take up work.

Henry said;

“It’s right that hard-working people are rewarded and that more people across the country benefit from the money they earn – especially as people around the world face a global rise in prices.

“So it’s welcome news that more than 2.6 million people across south east England will benefit from the rise in the National Insurance threshold – the single largest cut to personal taxes in a decade from this Government.

“This rise, which will benefit 30 million workers across the country, will be a huge help for household budgets across Crawley.”