- Henry Smith MP has welcomed news that people in Crawley will benefit from the long-term decisions taken by the Government at the Autumn Statement for Growth.

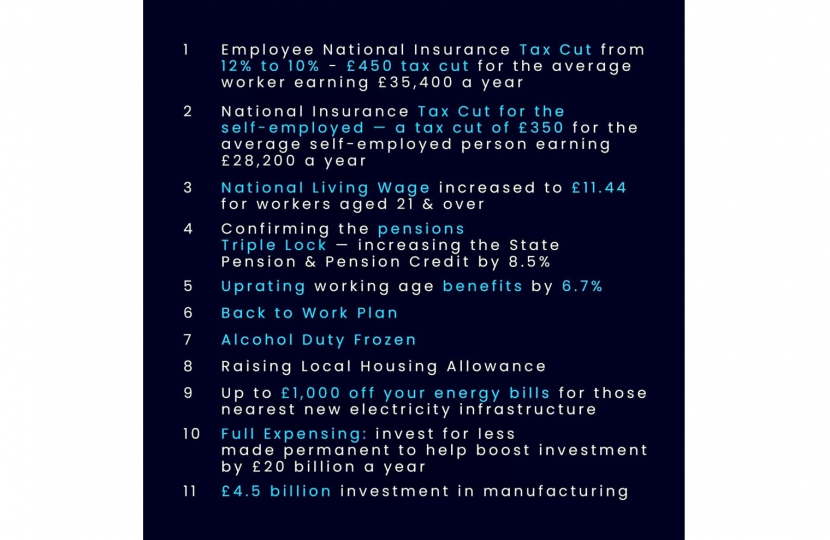

- The Autumn Statement for Growth 2023 cuts people’s National Insurance contributions, delivers an £11 billion business tax cut, cuts business rates for small business and gets more people into work by reforming welfare.

- This Autumn Statement takes the long-term decisions to reduce debt, cut taxes, reward hard work and back British business – making people and businesses better off.

Henry Smith MP has welcomed the Government’s Autumn Statement for Growth, taking the long-term decisions to reduce debt, cut taxes, reward hard work and back businesses in Crawley.

Henry said;

“Government is making progress in tackling the immediate pressures in the economy, such as reducing the rate of inflation to help people across Crawley with the cost of living.

“This Autumn Statement for Growth is a result of the difficult decisions which have been taken – meaning the Government are now in a position to cut taxes, for businesses and people, and boost economic growth across Crawley.”

With inflation falling, and global economic conditions stabilising, the Government are now able to take the long-term decisions required to strengthen the economy and build a brighter future for people across Crawley.

To ensure work always pays, the Autumn Statement for Growth cuts National Insurance Contributions for 29 million people and reforms the welfare system to toughen up work requirements, ensuring those in the welfare system are incentivised to work.

In the south east of England, 4,090,000 people will have their taxes cut by an average of £370 a year as a result of the Government’s long-term decisions for a stronger economy.

To back business, the Government have announced full expensing will be made permanent. That means businesses have their taxes cut every time they invest in the UK; this is an £11 billion a year tax cut. Businesses across Crawley will also welcome a cut to their business rates.

The Chancellor announced the freezing of the small business multiplier, which will protect over a million ratepayers from an increase in their business rates bills for a fourth consecutive year.

The Government is also extending the Retail, Hospitality & Leisure (RHL) relief, to protect small businesses, in our high streets and town centres, from unaffordable business rates bills.

Together, these measures represent a £4.3 billion support package. Freezing the business rates multiplier for small businesses for a fourth consecutive year will save an average shop £1,650, with 113,300 businesses in the south east benefitting.

Extending the Retail, Hospitality & Leisure relief will benefit 230,000 properties with almost £2.4 billion in support, protecting small businesses in our high streets and town centres. This measure will cut the cost of business rates for 37,405 businesses across the south east.

The Government are going further with the cost of living to support 1.6 million low-income families with an increase to their housing benefit.

To provide further support with the cost of living; the Chancellor has announced the Local Housing Allowance (LHA), which calculates housing benefits, will be raised, meaning 1.6 million families will be £800 better off in 2024-25. This will support 75,000 people across the south east.

The National Living Wage (NLW) will be boosted by its largest ever cash increase, ending low pay and ensuring hard work is rewarded.

From 1st April 2024, the NLW will increase by 9.8 per cent to £11.44 an hour, meaning that 310,000 people across the south east will see their wages rise.

This represents an increase of over £1,800 to the annual earnings of a full-time worker on the NLW and is expected to benefit around 2.7 million low paid workers.

Eligibility for the NLW will also be extended by reducing the age threshold to 21-year-olds for the first time. A 21-year-old currently on the National Minimum Wage (NMW) will receive a 12.4 per cent increase, from £10.18 this year to £11.44 next year, worth almost £2,300 a year for a full-time worker.

Since 2010, the minimum wage rate will have risen by £5.64. Young people and apprentices on the NMW will also see a boost to their wages.

Earlier this month it was also announced the proportion of workers on low pay has halved since 2010, thanks to the National Living Wage.

The Autumn Statement for Growth also backs new technologies with a £4.5 billion advanced manufacturing fund and also announces new Investment Zones – backing business and supporting new jobs.

The Government is making huge progress in tackling the long-term economic challenges facing the UK meaning a more dynamic economy that delivers prosperity across the United Kingdom.

The Chancellor of the Exchequer, Jeremy Hunt, commented;

“With inflation falling, and global economic conditions stabilising, we are now able to turn our attention to the long-term decisions required to strengthen our economy and build a brighter future.

“Our Autumn Statement for Growth takes those long-term decisions to reduce debt, cut tax, reward hard work and back British business right across the country.

“By doing so we are making huge progress in tackling the long-term economic challenges facing the UK so we can build a more dynamic economy that delivers prosperity across our United Kingdom.”