The UK economy has outperformed expectations this year. Inflation – which inflicts rising prices on us all – is less than half its peak.

Responsible decisions by Government to limit borrowing have supported the independent Bank of England in their work to bring inflation down from over 11 per cent last autumn to 4.6 per cent in October.

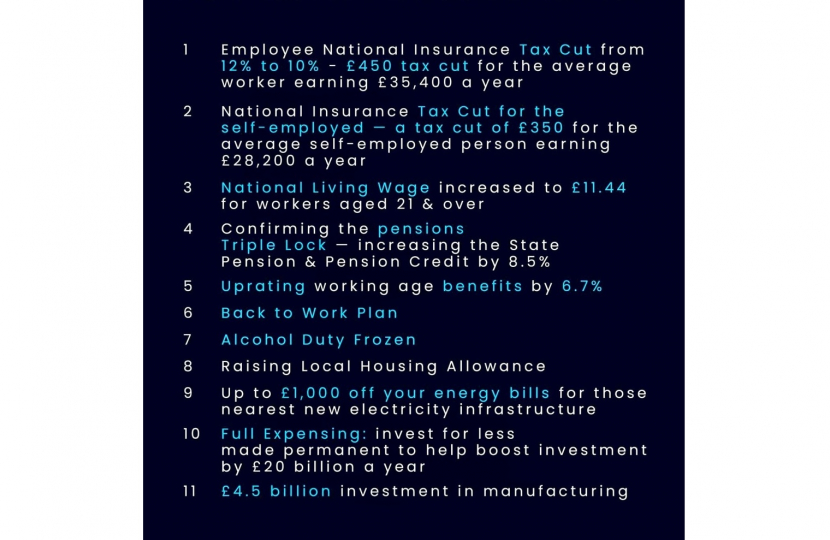

Fiscal events such as the Autumn Statement are an opportunity for a Government to set out its stall and highlight what its priorities are.

Backing people in their day-to-day lives is essential and I welcome the Chancellor of the Exchequer confirming tax cuts, boosting wages and enhancing support for the vulnerable.

We know that the best way to help workers is to ensure they are able to keep more of the money they earn.

From January 2024, Employee National Insurance will be cut from 12 per cent to 10 per cent: a tax cut of £450 for the average worker earning £35,000.

National Insurance for the Self Employed is also being cut: a total average saving of £340 a year.

From 1st April 2024, the National Living Wage (NLW) will increase by 9.8 per cent to £11.44 an hour. This marks a boost of over £1,800 to the annual earnings of a full-time worker on the NLW; expected to benefit around 2.7 million workers.

NLW eligibility will also be extended by reducing the age threshold to 21-year-olds for the first time.

Since 2010, the minimum wage rate will have risen by £5.64. Young people and apprentices on the National Minimum Wage (NMW) will also see a boost to their wages.

I note that earlier this month it was announced the proportion of workers on low pay has halved since 2010, thanks to the National Living Wage.

A further measure confirmed at the Autumn Statement will see extra support with the cost of housing for some 75,000 households in the south east of England.

Local Housing Allowance – used to calculate housing benefits – will be raised and means 1.6 million families will be £800 better off overall in 2024-25.

Crawley pensioners will also receive a boost – in line with the Triple Lock – of 8.5 per cent. Indeed, the basic State Pension will be £3,750 higher than in 2010.

Working-age benefits will be uprated by 6.7 per cent in 2024-25. The Back to Work Plan – supported by over £2.5 billion in funding – will reform the welfare system to better support people into work.

It is through backing our businesses that jobs are created and the Autumn Statement cuts business rates by freezing further the small business multiplier – saving an average shop £1,650 – and extending the Retail, Hospitality & Leisure Relief for a year.

Henry Smith MP